New federal authority surrounding stress tests means banking supervisors take a back seat to regulators.

In the field of banking and financial regulation, the past five years have been nothing short of a revolution. In particular, a key methodological and epistemological change that recently occurred deals with the form and use of stress tests in banking regulation. These tests seek to simulate on paper how a bank will fare under a variety of risky economic circumstances, in the hope of ensuring that if such challenging circumstances should happen to arise, the bank will have enough assets to remain solvent. And their increased use could spell the end of bank supervision as we have understood the concept for almost 150 years.

Before the 2008 financial crisis and the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 (Dodd-Frank), the line between “bank regulation” and “bank supervision” was relatively easy to summarize. “Regulation” was the rulemaking that administrative agencies issued pursuant to some statutory authority. “Supervision” was the micro-application of regulation to individual firms, a kind of check-the-box exercise that ensured that the supervisors saw in the banks what the regulators wanted them to see. In other words, the regulators made the rules, and the supervisors made sure the rules were followed. (A third leg in this stool might be the enforcers who would prosecute failure to comply, but we’ll leave the discussion of financial enforcement for another day.)

Regulators spent their time in Washington in a dialogue between bureaucrats, legislators, industry representatives, industry critics, and members of the administration trying to make sense of what the rules should be. Supervisors worked on the ground—often coming to work day-in and day-out on the site of the banks themselves—making sure that the regulated banks’ activities conformed to the regulatory design.

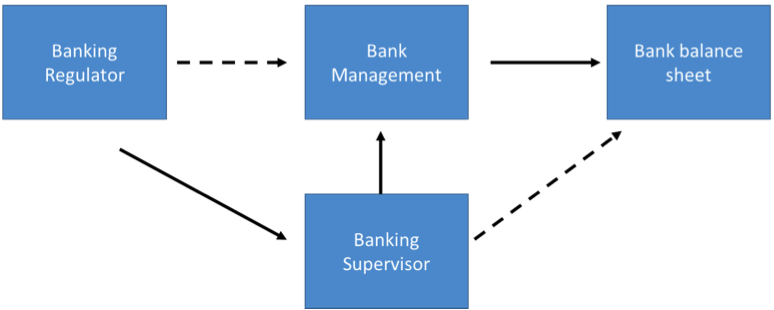

The financial crisis and the subsequent legislative and regulatory response changed this basic design with the advent of the epistemologically scrambling “stress tests,” a broad family of activities that apply to the largest financial institutions. To be clear, there is nothing new about stress testing as a conceptual tool in subjecting firms’ balance sheets to certain kinds of risks. As I discussed in one of my first academic articles, these kinds of in-house tests have been part of the basic financial architecture for firms for decades. (An excellent article by Robert Weber offers an even deeper dive into the history here.) Figure 1 shows the kind of model of regulation and supervision that dominated prior to Dodd-Frank.

Figure 1: Bank Supervision and Regulation Before Dodd-Frank

The solid lines in Figure 1 represent the level of interaction between the entities. The regulators within, say, the Federal Reserve System, are nominally the seven Governors on the Board of Governors. But the supervisors were lower-level managers and staff who worked mostly out of the twelve regional Federal Reserve Banks. Those supervisors would interface with the bank management and the regulators at the Board, and the managers would prepare access to the bank balance sheet that was the focus of the supervisors.

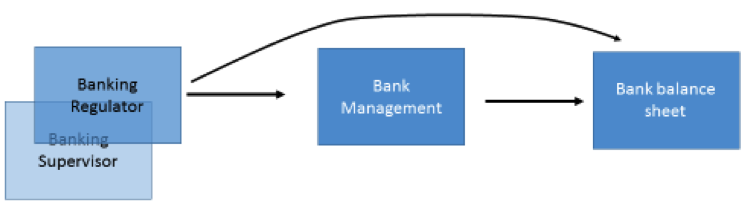

Dodd-Frank requires something new. It gives the Federal Reserve’s Board of Governors the authority to set the parameters of these tests and requires them to arise in parallel. That is, for the first time both private firms and their regulators simultaneously engage in stress testing the firms according to “stress” conditions established by the regulators. Now, the relationship looks more like that in Figure 2.

Figure 2: Bank Supervision and Regulation After Dodd-Frank

Both of these figures are very stylized—the reality of the web of relationships is much more complex than this. But with stress testing, banking supervisors effectively take a back seat to banking regulators, who are setting the rules for how the banks will measure their risk exposures. Under the previous model shown in Figure 1, the question was, “Do you have an internal risk management system?” Check the box “yes” or “no.”

Under the current model, the questions are much more specific: “Do you have an internal risk management system? What does it say about your performance in the face of the following kinds of adverse circumstances? And now, provide us with access to your balance sheet so that we can perform these same kinds of tests but with our own models.”

This sea change is extraordinary. I’ve recently been working on a book project with Sean Vanatta to understand the long, complex history of federal bank supervision since the field’s creation in the aftermath of the Civil War. Although the financial system itself has been anything but stable in the 150 years since the end of the Civil War, as I take a deep dive into the history of supervision I am learning how remarkably stable the methodology of bank supervision has been. To quote one of our favorite examples, the Examination Report from the Comptroller of the Currency for each bank remained the same in general form from 1865 to 1953—an extraordinarily stable institutional arrangement across a long period of economic, political, legal, and financial tumult.

Is change a good thing or a bad thing? It is not clear to me that we have the information we need to reach a determination, although I am cautiously optimistic that the version of banking regulation and supervision in Figure 2 is a change that we should embrace. From my perspective, though, what is more important than determining whether change is a good or bad thing is that we get to the root of what this thing is in the first place.

This essay is part of The Regulatory Review’s sixteen-part series, RegBlog@5.