Arming the public with the right information is good for securities markets, but information overload is not.

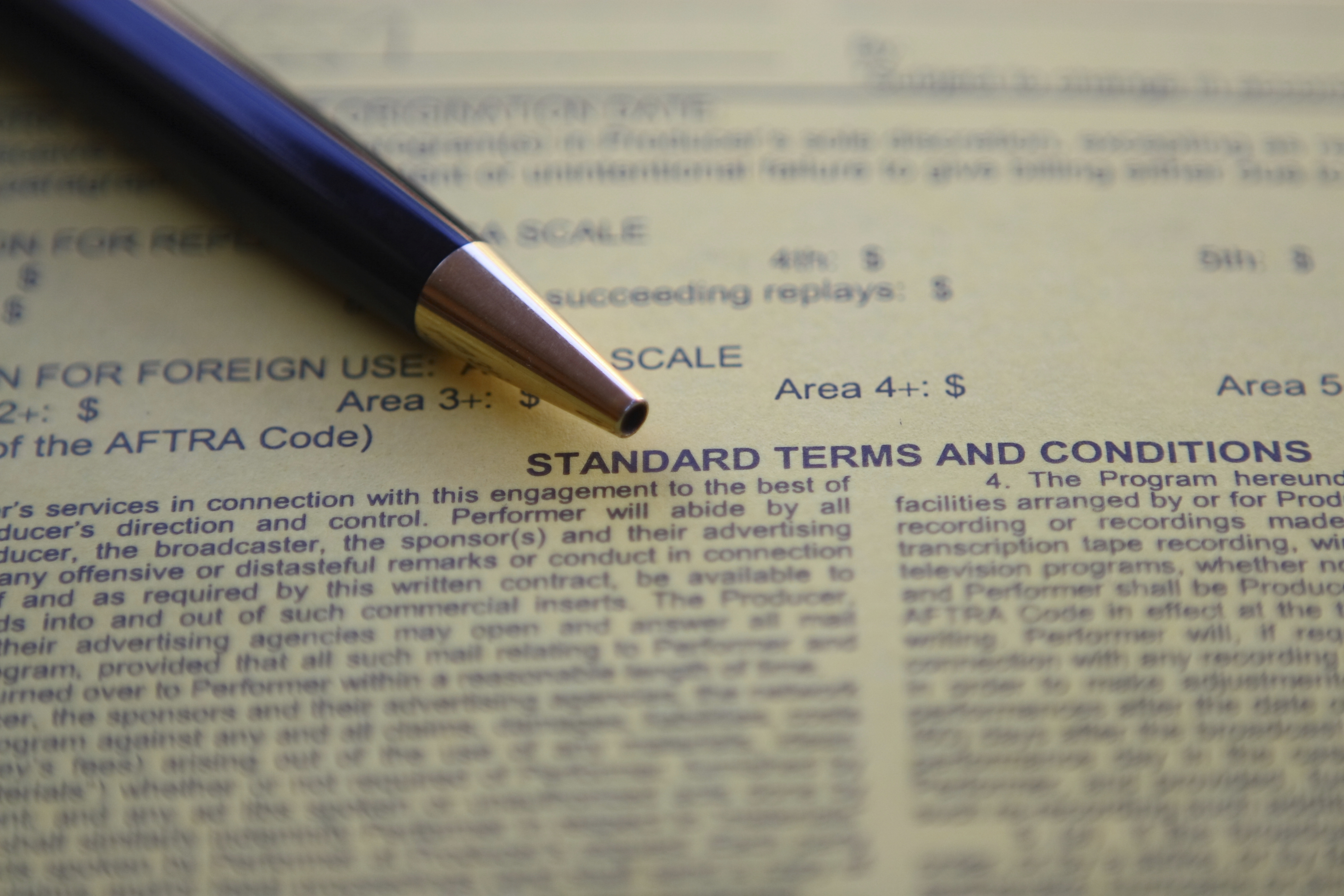

There is no denying that information is empowering. Generally speaking, we make better decisions when we have better information. But it is also true that information can be overwhelming. We have all thrown up our hands in frustration when faced with reading a very long document – let alone a pile of documents – laden with small font and legalese that would confuse even a lawyer.

This captures the basic tension that professors Omri Ben-Shahar and Carl Schneider tackle in their excellent book, More Than You Wanted to Know – namely, how to reconcile the benefits and costs of mandatory disclosure. They highlight a range of settings where we find mandatory disclosure at work, from mortgages to health care to privacy warnings. Ben-Shahar and Schneider thoughtfully consider how people use the information they have, focusing on how real-life people make real-life decisions. Key to their critique of mandatory disclosure is their view of the effects of mandatory disclosure, the politics of disclosure regulation, and how mandatory disclosure compares to more substantive regulation. They conclude that mandatory disclosure “routinely fails” and “cannot be fixed.”

I highly recommend More Than You Wanted to Know, although I must say that I am more optimistic about both the promise and the practice of mandatory disclosure. Perhaps I am biased because mandatory disclosure is the core of the regulatory regime that I spend most of my time thinking about. That regulatory regime is federal securities regulation, to which I want to turn given its relevance to the book’s topic.

The essence of the disclosure philosophy of securities regulation is straightforward. Armed with information, people can make informed decisions when deciding how to invest. Not only is this good for investors, but it also means that capital is more likely to find its highest and best uses, backing the most productive enterprises. This is good for all of us because it promotes growth and prosperity.

It does not always play out quite this neatly in reality, as Ben-Shahar and Schneider might be quick to point out. For example, even when people possess useful information, certain decision-making shortcuts and cognitive biases may cause them to make unfortunate decisions that they would like to have back. Setting aside what psychology has to say, sometimes people just get it wrong. The future is hard to predict, regardless of how clear-eyed our thinking is.

Although investors are not perfect decision makers, it is still better to have investors decide which businesses to fund than to have government officials make capital allocation decisions or otherwise pick winners and losers. Recognizing this, the federal securities laws have long rejected “merit review” – the idea that investors should only be permitted to invest in the securities of companies that regulators decide meet certain substantive standards – in favor of a mandatory disclosure regime that assists investors in making their own decisions by providing them with information.

The mandatory disclosure regime of the federal securities laws, however, is not flawless. One flaw in particular jumps to mind: information overload, something that Ben-Shahar and Schneider also consider.

Disclosure is powerful, but that does not mean that more disclosure is always better than less. Case in point: public company filings with the U.S. Securities and Exchange Commission (SEC) – for example, annual reports on Form 10-K – have become too long. Too often, SEC filings are full of too much repetition and too much information that is not useful to investors. When investors have to pore over dense, lengthy documents they may miss important information and struggle to digest what is disclosed.

Exacerbating things, securities disclosures can be unnecessarily complicated.

As SEC Chair Mary Jo White has put it: “Ever-increasing amounts of disclosure make it difficult for an investor to wade through the volume of information she receives to ferret out the information that is most relevant.” Indeed, investors may decide to ignore a document entirely, throwing it aside because they do not have the time to read it or because it is not readily comprehensible.

Information overload, therefore, presents an ironic twist for a mandatory disclosure regime. At some point, more disclosure can result in worse decisions.

So what should be done? SEC disclosure documents should be streamlined and simplified so that they are easier for investors to use. As a start, disclosure requirements that are outdated or of little use to investors in deciding how to invest should be deleted, and there should be less repetition in SEC filings. It goes without saying that we should not add to the overload problem in the future by mandating that companies disclose information that is not material to evaluating a company’s business.

To help investors focus on and process what matters most to them, whatever is disclosed should be presented, when practicable, in an accessible, straightforward manner such as charts, graphs, tables, and summaries. Furthermore, disclosures should be “layered,” using technology so that investors can easily “click through” to focus on the more detailed information they are especially interested in without getting bogged down by everything else.

Instead of giving investors more than they want to know, why not allow investors, in a user-friendly way, to decide for themselves what information to access and how to use it?

In addition to these suggestions, many other ideas have come to the SEC’s attention from many interested parties. I know first-hand from my time as a commissioner that the SEC takes input like this seriously and that it can influence the SEC’s direction.

Which leads to some good news. The SEC is reviewing its mandatory disclosure regime to try to make it more effective, including looking at how to correct for information overload. This means that the kind of regulatory change that is needed – and that many commenters have recommended – could really occur, eventually streamlining and simplifying public company disclosures.

The challenge, at this time, is to get it done. Notwithstanding other demands on the SEC, the agency should prioritize turning its disclosure review into actual disclosure reform that remedies the overload problem. There is every reason to do so now and no good reason not to.

This essay is part two of a seven-part series on The Regulatory Review entitled, Is Mandatory Disclosure Helping Consumers?